Privatization/Vouchers

Explore Privatization Topics

Vouchers and Other Diversions of Public Funds to Private Schools

What the research says about private school vouchers

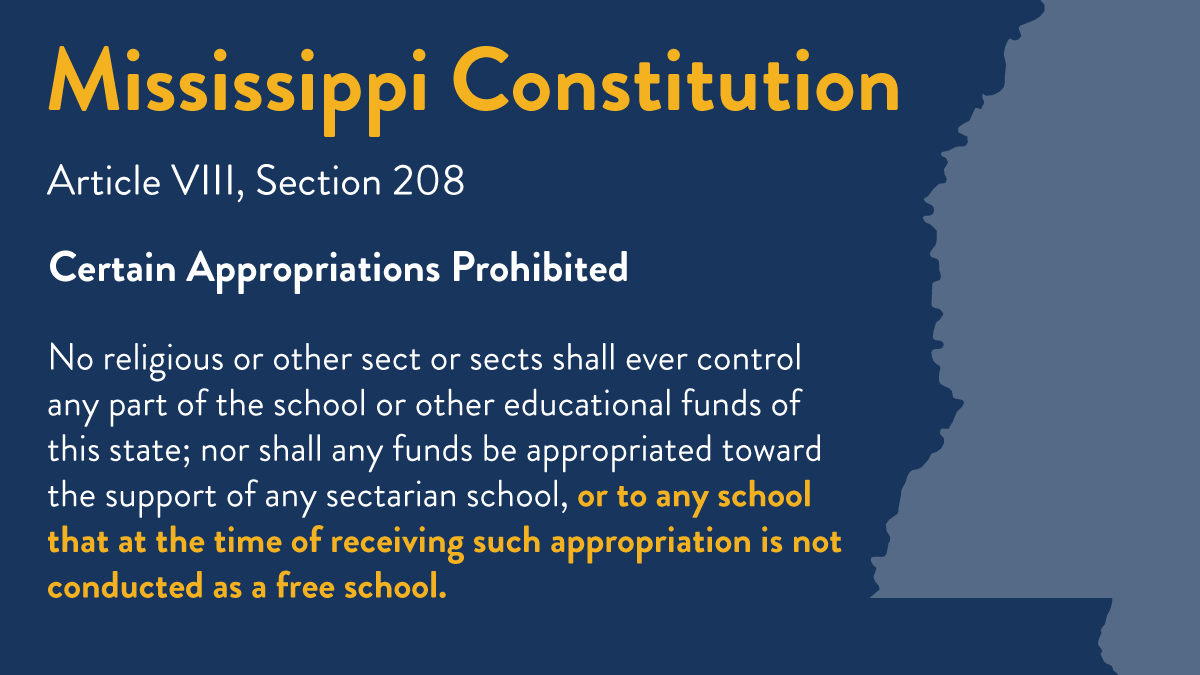

Vouchers are state-funded certificates that are used to pay tuition to private schools. Mississippians have been so opposed to using taxpayer dollars to fund private schools that our constitution bans these voucher payments. Savvy folks who have long sought to privatize our public schools now are attempting to circumvent the constitution – and the will of the people – by using tax credits and education savings accounts to funnel state tax dollars to private schools.

The most recent research on the academic impact of private school vouchers finds that voucher students experience significant losses in achievement. Prior research showed that gains in achievement were about the same for low income students receiving vouchers as they are for comparable public school students.1

Long-term studies of voucher programs in Milwaukee2, the oldest school choice/voucher program in the U.S., Cleveland3,4, and the District of Columbia5 found no advantage in academic achievement for students attending private schools with vouchers.

In Louisiana, students using vouchers to attend private schools were 24-50% more likely to score below Basic (failing) in the four tested subjects than comparable students in public schools.6 By the end of year 4 of Louisiana’s voucher program, voucher students “performed noticeably worse on state assessments than their control group counterparts.”7

Ten years of longitudinal data on Ohio’s EdChoice voucher program found persistently lower achievement for voucher students relative to public school peers in both math and English language arts (ELA), with the greatest disparity in math.8

Wisconsin introduced vouchers in 1990 and by 2023 provided them to 50,000 students annually across the state. Wisconsin requires its voucher students to take the same state tests used in public schools, allowing a direct comparison of the achievement of private school voucher students and public school students. Performance results from the 2022-2023 school year showed dramatically lower proficiency rates for private school voucher students in both math and ELA as compared to their public school peers. Public school students had proficiency rates of 38.9% in ELA and 37.4% in math, while the proficiency rates of private school voucher students was 22.1% in ELA and 17.9% in math.9

Annual studies of Florida’s tax credit (voucher) program showed negligible changes for private school voucher students. Of the 158 private voucher schools reporting more than 30 students, only 18 schools achieved statistically significant, though small, gains in reading and math from 2011 – 2014. Another 31 schools produced statistically significant losses over the three-year period. Most schools’ voucher students performed about the same as they had in previous years, neither gaining nor losing ground when compared to their peers (Florida no longer reports comparative scores for in-state public school and voucher students).10

Competition and choice have failed to produce achievement gains in the countries that have tried the approach, while global leaders in achievement (Korea, Finland, Hong Kong, Singapore, and Canada) have succeeded by building capacity within public schools. A study of Indiana’s voucher program found that all of its core concepts are contrary to these best practices of high-achieving nations – improving teacher quality and instructional practices, encouraging mentoring and collaboration, and investing sufficient resources to implement changes.11

A real-world example of how competition affects achievement

School choice proponents claim that the mere existence of competition from voucher-receiving private schools generates improvement in nearby public schools. Milwaukee, which has the nation’s oldest voucher program, offers a real-world example of how a “competitive marketplace” of education options affects achievement in traditional public schools. After three decades of voucher competition, 84% of the city’s public school students were not proficient in ELA and 88% were not proficient in math12; 80% of private school voucher students were not proficient in ELA and 84% were not proficient in math.13

Tax credits: Subsidizing private education for wealthy families

By allowing tax credits for contributions to private schools, the Legislature is telling taxpayers, “You can just write a check to your private school instead of paying your taxes, and we will deduct that amount from the taxes you owe the state.” It’s a tax write-off for private school patrons, while the state foots the bill for private schools. It is a clear circumvention of the intent of our constitution.

This scheme of subsidizing private education with public funds is happening in a big way in Mississippi. In 2019, the Legislature passed the Children’s Promise Act, a bill providing tax credits for donations to agencies that provide services to foster children. The bill was presented and voted on without disclosure of a separate statute within it that provides tax credits for donations to private schools. The measure has been renewed each year along with increases in allowable tax credits. Legislators now shift $9-million in taxpayer funds annually to unaccountable private schools through the program. Private schools can receive up to $405,000 in public funds per school each year, with no restrictions on expenditures and no reporting requirements. In the 2024 Legislative Session, there is a House proposal to increase these taxpayer-funded subsidies to private schools significantly – to a total of $15-million in 2024 and $24-million in 2025 and beyond.

See list of private schools that received these taxpayer-funded subsidies in 2022.

See list of private schools that received these taxpayer-funded subsidies in 2023.

ESAs: Shifting public funds to unaccountable private schools

Education savings accounts (ESAs) originated in model legislation from the American Legislative Exchange Council (ALEC). ESAs are designed to circumvent state law by handing parents state tax dollars that have been diverted from public schools in exchange for a commitment from the parents to use the funds for any of a variety of “educational” purposes, such as private schools, tutoring, cyber schools, textbooks, etc. There is little to no accountability or oversight for the expenditure of these funds.

In more recent “universal” ESA programs, the vast majority of vouchers go to students who never attended public schools. States including Arkansas, Arizona, Florida, and Iowa, have seen relatively low participation from former public school students, meaning these states are instead subsidizing tuition for children who always have been enrolled in private schools.

Read about the pitfalls in Mississippi’s ESA voucher program.

Bottom line regarding diverting public funds to private schools

Study after study conducted in multiple states confirm that schemes to shift public funds to private education provide no achievement benefit for the students they purport to help, while depleting funds intended for public schools. Voucher students perform about the same, and often worse, in unaccountable private schools than they did in public schools, and public schools are left with diminished resources.

School Voucher Scam, The Parents’ Campaign Research & Education Fund, September 2023

Sources

1 Keeping Informed About School Vouchers: A Review of Major Developments and Research, Center on Education Policy, 2011 See report

2 Comprehensive Longitudinal Evaluation of the Milwaukee Parental Choice Program: Summary of Fourth Year Reports, 2011

3 Evaluation of the Cleveland Scholarship and Tutoring Program: Summary Report, Indiana University, 1998-2004, 2006

4 The Evidence on Education Vouchers: An Application to the Cleveland Scholarship and Tutoring Program, City University of New York, 2006, commissioned by the National Center for the Study of Privatization in Education

5 Evaluation of the D.C. Opportunity Scholarship Program: Final Report, University of Arkansas and Georgetown University, 2010, commissioned by the U.S. Department of Education

6 School Vouchers & Student Achievement: First-Year Evidence from Louisiana Scholarship Program, National Bureau of Economic Research, 2015 See report

7 The Effects of the Louisiana Scholarship Program on Student Achievement After Four Years, School Choice Demonstration Project, University of Arkansas, 2019 See report

8 Evaluation of Ohio’s EdChoice Scholarship Program, Thomas B. Fordham Institute, July 2016 See report

9 Wisconsin Department of Public Instruction, 2023

10 Evaluation of the Florida Tax Credit Program, Florida State University, 2015

11 Analysis of Indiana School Choice Scholarship Program, Center for Tax and Budget Accountability, 2015 See report

12 Wisconsin Department of Public Instruction, Milwaukee Public Schools 2022-2023 District Report Card, 2023

13 Wisconsin Department of Public Instruction, Milwaukee Parental Choice Program 2022-2023 Final Results, 2023